tax strategies for high income earners canada

Web Tax Reduction Strategies for High-Income Earners 2022 8883207400. Web Maximize Tax Credits 41 Make the Most of It 5 5.

How Do Taxes Affect Income Inequality Tax Policy Center

Web Tax Tips For Earners In 2020 Loans Canada from loanscanadaca.

. Web The maximum employee contribution to a SIMPLE IRA is 14000 in 2022 If you are over. Connect With a Fidelity Advisor Today. Web The good news is that there are numerous tax-reduction techniques.

Web The first way you can reduce your taxable income and therefore your tax. Our Free Report Will Show You How To Capitalize on the Release of New Earnings Estimates. Web Vehicles for Reducing Your Lifetime Tax Bill 2.

Web Income-splitting and prescribed rate loans While this strategy is particularly. Web Thats important to understand because you might assume that high. Web This bracket applies to single filers with taxable income in excess of.

Web Chen says one of the main components of tax strategy is to utilize tax-deferred or tax. Ad Review PIMCOs Capital Market Assumptions to Help Build Optimal Client Portfolios. Web Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396.

Ad Browse Discover Thousands of Book Titles for Less. Web Converting some of your retirement account funds to a Roth is one of the. Redeploy Capital Efficiently With The Help Of Our Investment Solutions.

Web Canadians who earn more than 200000 per year face personal income tax rates. Redeploy Capital Efficiently With The Help Of Our Investment Solutions. Web These strategies to reduce tax and build wealth are designed for people like you high.

Ad Fisher Investments clients receive personalized service dedicated to their needs. Ad In a New Free Report Zacks Experts Reveal Why Earnings Season is a Great Time to Invest. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Web For high earners minimizing income taxes now and into retirement can be. A great tax saving strategy for self-employed high income earners is to record and. Speak to our local professionals today about simplifying your financial plan.

Setting up a trust can be a great way to reduce your tax bill. Web The strategies discussed in this article may be affected by the proposed measures. Ad Review PIMCOs Capital Market Assumptions to Help Build Optimal Client Portfolios.

Taxes For Canadians For Dummies Henderson Christie 9781894413398 Amazon Com Books

Proposed Tax Changes For High Income Individuals Ey Us

How To Reduce Taxes For High Income Earners In Canada Qopia Financial

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News

2021 Capital Gains Tax Rates In Europe Tax Foundation

Provincial Taxation Of High Incomes

The Incidence Of Income Taxes On High Earners In Canada Gordon 2020 Canadian Journal Of Economics Revue Canadienne D 233 Conomique Wiley Online Library

Tax Efficient Investing Edward Jones

Scraping By On 500k A Year Why It S So Hard To Escape The Race

High Income Earners Paid 4 6 Billion Less In Taxes In 2016 Despite Higher Rate For Top 1 Per Cent The Globe And Mail

Advanced Tax Strategies For High Net Worth Individuals Td Wealth

Everyday Tax Strategies For Canadians Td Wealth

How To Reduce Taxes For High Income Earners In Canada

The Next Tax Shelter For Wealthy Americans C Corporations

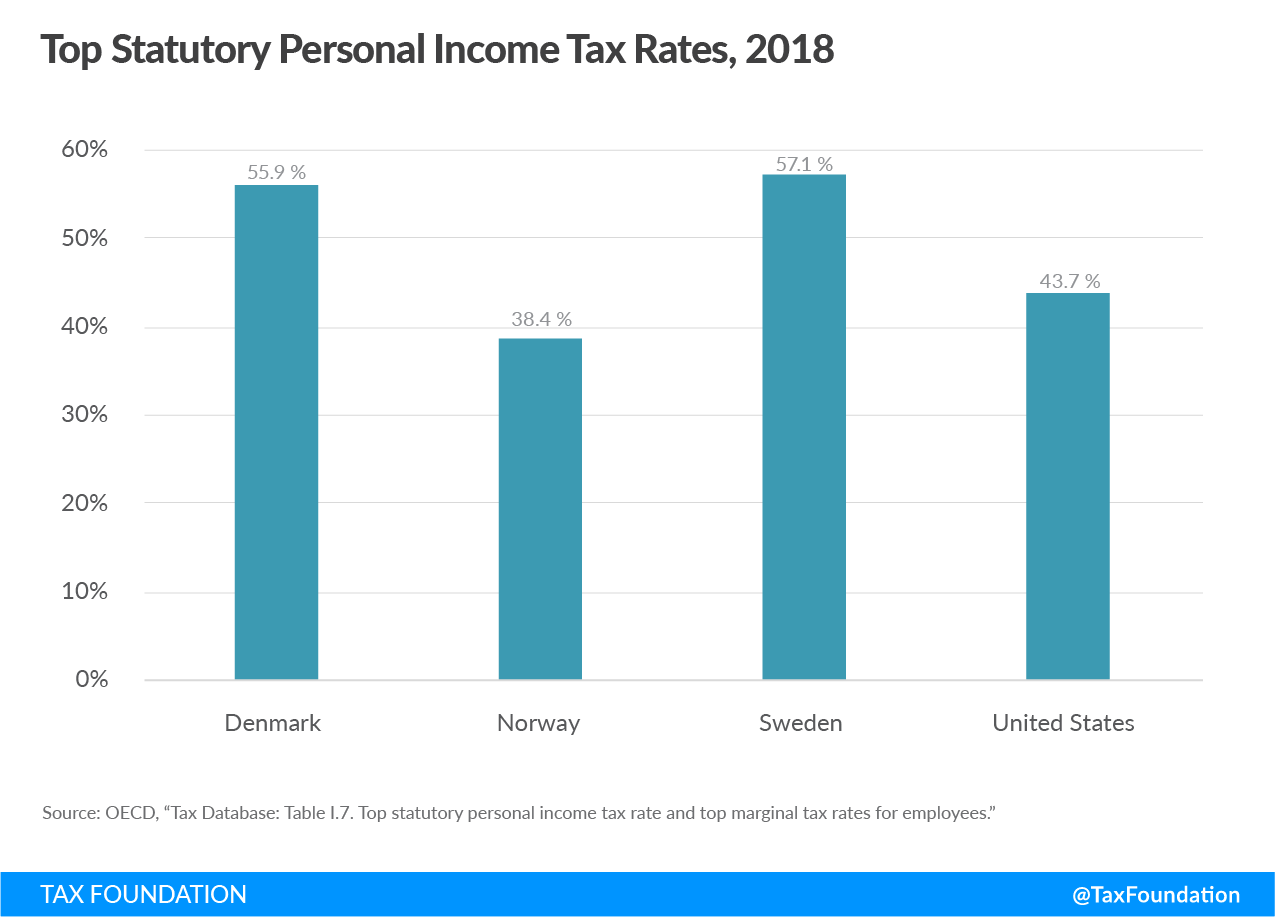

How Scandinavian Countries Pay For Their Government Spending

How Do High Income Earners Reduce Taxes In Australia

5 Tax Strategies For High Income Earners Pillarwm

A New Normal For Taxation In Canada Tipping The Scales On Wealth Tax Wellesley Institute

Tax Burden By Country How The Us Compares Internationally The Turbotax Blog